04/11/2025

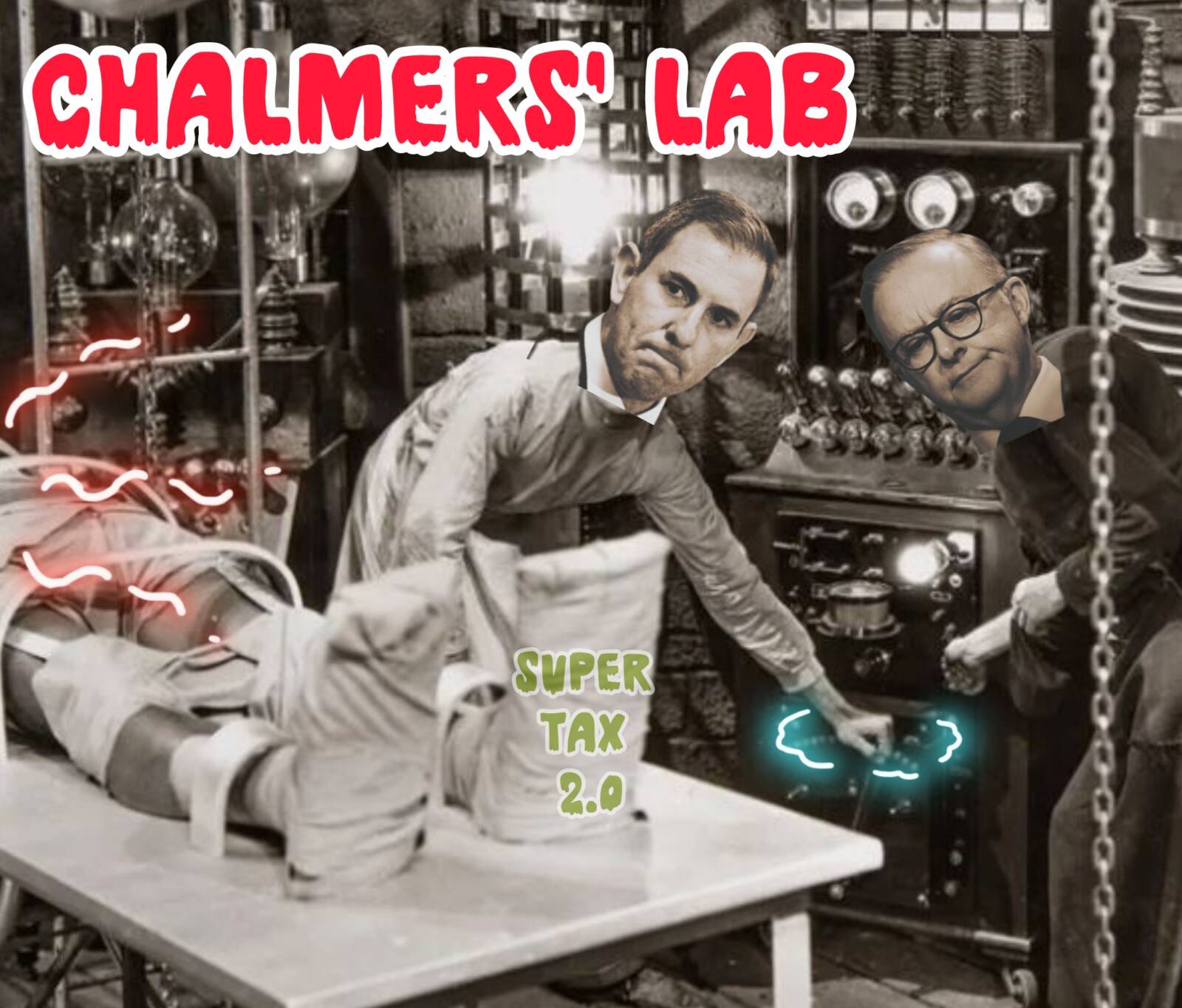

Following his embarrassing backflip, Treasurer Jim Chalmers is back in the lab attempting to resurrect the dead with his “new and improved” Super Tax 2.0 – an unnatural tapestry of salvaged parts from the carcass of his original plan – with early signs suggesting it’s shaping up to be monstrously more confusing, bureaucratic, and costly than the original.

Reports from across the superannuation sector are already sounding alarm bells, warning the revised tax will create major administrative burdens for funds, requiring what some have described as “heroic guesswork” just to calculate the tax obligations for individual members.

“Labor should stop experimenting with your super,” Shadow Assistant Treasurer Pat Conaghan said. “I am concerned Jim Chalmers is replacing one broken model with another bureaucratic mess – and average Australians will end up paying for it.

“The Treasurer’s first super experiment – that taxed unrealised gains – was widely criticised by economists, industry leaders and taxpayers alike. Now industry insiders warn the new version risks imposing even greater compliance costs on funds, costs that will inevitably be passed on to all members – not just those above the $3 million threshold.”

The independent Grattan Institute has already cautioned that the regulatory impact statement for the revised policy will “look horrible” – a reflection of its complexity and regulatory costs that will be passed on to ordinary members’ balances.

“Instead of finding new ways to tax super, Labor should focus on protecting it,” Mr Conaghan said. “After the collapses of First Guardian and Shield, Australians deserve a government that finally releases the Managed Investment Scheme review and sets ASIC with a new statement of expectations.”

The Government was meant to fix the issue of taxing unrealised gains, but under the new proposed model funds are worried they will need to make guesses about what gains to attribute to individuals – some with 15 per cent, some with 30 per cent, and some with 40 per cent tax rates. Administering these changes will drive up costs and red tape for funds, and increase costs paid by everyday members.

“Your retirement savings shouldn’t be footing the bill for another Labor experiment,” Mr Conaghan said. “The Coalition will always back a fair, simple and sustainable super system that protects your savings and keeps costs low.”